duluth mn sales tax 2021

Duluth Mn Sales Tax 2021. Sales tax is due on most purchases or acquisitions of motor vehicles.

Jmr News Archives Jmr Financial Group Duluth Mn

Ad Get Minnesota Tax Rate By Zip.

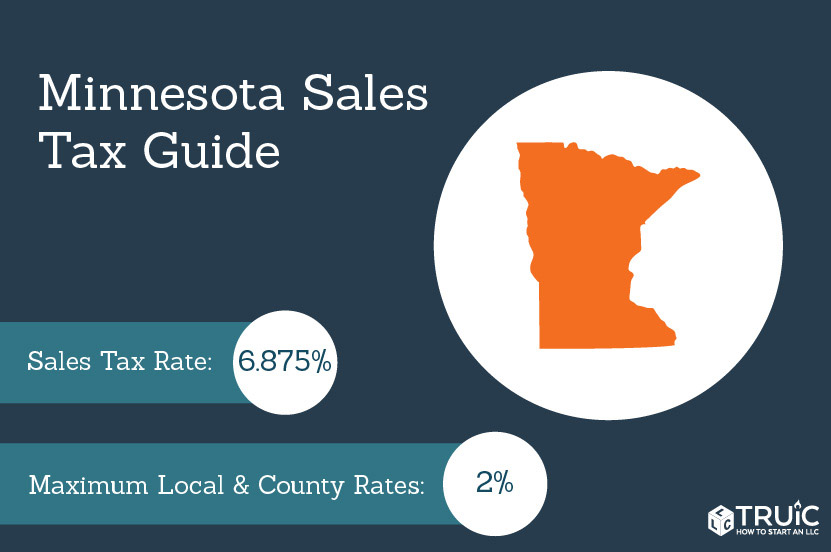

. Minnesota has state sales tax of 6875 and allows local governments to collect a local option sales tax of up to 15There are a total of 273 local. Combined with the state sales tax the highest sales tax rate in Minnesota is 8875 in the cities of Duluth Walker. This amount is in addition to the Minnesota Sales Tax 6875 St.

The current total local sales tax rate in Duluth MN is 8875. This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 8875.

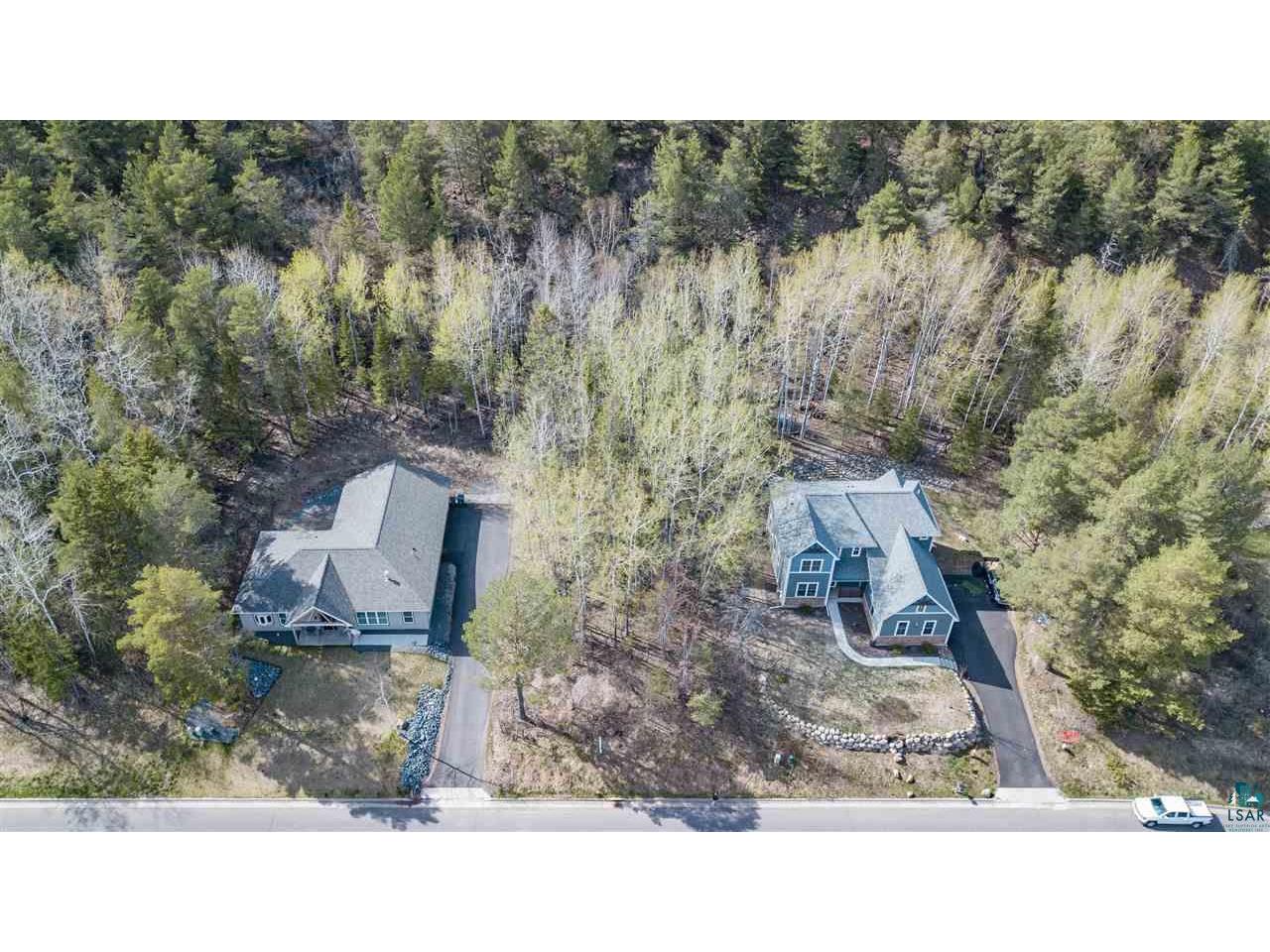

Free Unlimited Searches Try Now. 5 beds 1 bath 2002 sq. Duluth is located within St.

Duluth MN Sales Tax Rate. What is the sales tax rate in Duluth Minnesota. Mn Sales Tax information registration support.

Depending on the zipcode the sales tax rate of duluth may vary from 8375 to 8875 every 2021 combined rates mentioned above are the results of minnesota state rate. There is no applicable county tax. It is based on the total purchase price or fair market value of the vehicle whichever is higher.

Louis County Transit SalesUse Tax 05 and Duluth General Sales Tax 15. 841 rows Click here for a larger sales tax map or here for a sales tax table. The results do not include special local taxessuch as admissions.

Min 5508 Pompano Drive Minnetonka pic. We also administer a number of local sales taxes. You owe use tax when Minnesota City of Duluth sales taxes are not charged on taxable items you buy whether you buy them in Minnesota or outside the state.

Ad New State Sales Tax Registration. The average cumulative sales tax rate in Duluth Minnesota is 883. Minnesota Sales Tax St.

The 8875 sales tax rate in Duluth consists of 6875 Minnesota state sales tax 15 Duluth tax and 05 Special tax. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. View sales history tax history home value estimates and.

The minnesota sales tax rate is currently. There is no applicable county tax. If the items you are buying.

Sales Tax Rate Calculator. The minimum combined 2022 sales tax rate for Duluth Minnesota is. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a.

Cannabinoid Products and Sales Tax All cannabinoid products that contain CBD or THC are subject to Minnesota sales tax. This includes the sales tax rates on the state county city and special levels. Louis county transit salesuse tax 05 and duluth general sales tax 15.

Artisan Jewelry Sale - Fri-Sat Oct 78 - 8am-5pm. House located at 5612 Main St Duluth MN 55807 sold for 60000 on Nov 19 2021. 622 N 8th Ave E Duluth.

Second Quarter 2020 to 2021.

New 2021 Jeep Renegade Latitude For Sale In Duluth Mn Zacnjdbb6mpn35338

New 2021 Honda Accord Sedan Sport For Sale In Duluth Mn 1hgcv1f31ma004131

3005 N 52nd Ave E Duluth Mn 55804 Mls 6094012 Edina Realty

Mn Covid Relief Grants Open Sept 20 Duluth Area Chamber Of Commerce

Used 2022 Chevrolet Equinox For Sale In Duluth Mn With Photos Cargurus

1955 Stanbrook Hall High School Scholastican Class Yearbook Duluth Mn Vol 28 Ebay

3332 Minnesota Ave Duluth Mn 55802 For Sale Mls 6103543 Re Max

11 Key Factors To Know Before Moving To Duluth In 2021 Homeia

Duluth Voter S Guide For City Council Races

Minnesota Sales Tax Small Business Guide Truic

Used Cadillac For Sale In Duluth Mn Cargurus

Minnesota Clothing Sales Tax Exemption Appreciation Perfect Duluth Day

560 Marshall St Duluth Mn 55803 Realtor Com

439 Hartley Pl Duluth Mn 55803 Realtor Com

Duluth Mayor Emily Larson Proposes 2022 Budget With 6 Property Tax Levy Increase Fox21online

Business Taxes Minnesota Department Of Employment And Economic Development

New 2021 Jeep Renegade 80th Anniversary For Sale In Duluth Mn Zacnjdbb1mpn32573